Credit Analysis Platform

Credit analysis is one of the most sensitive pillars for decision-making in insurers, brokers, financial institutions, and companies that assess the financial health of their clients and suppliers with a large volume of operations.

Yet, it’s still common to find manual, time-consuming processes with a high margin of error — compromising not only speed but also accuracy in decision-making.

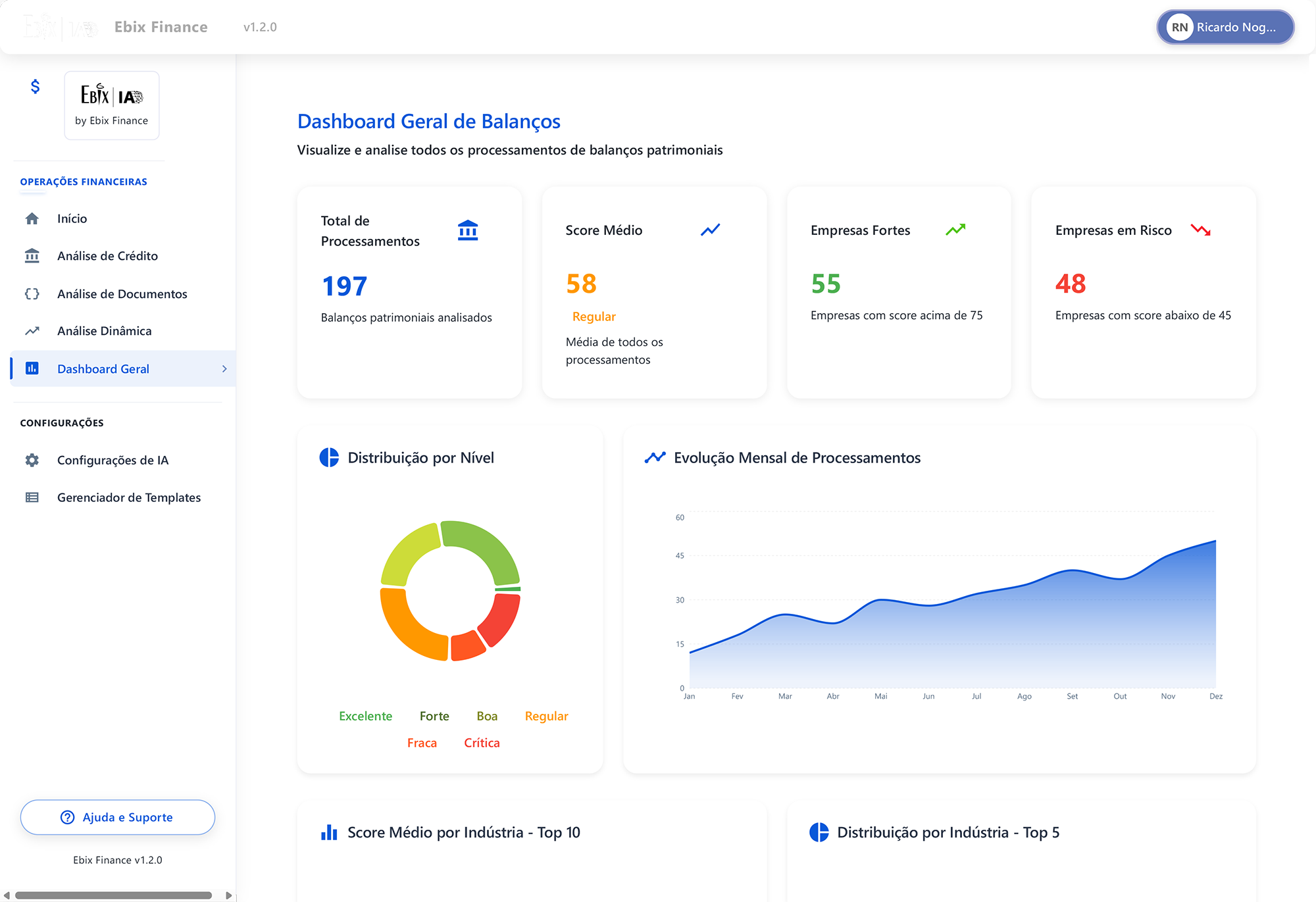

Ebix Latin America, a leading insurtech, introduces its AI-Powered Credit Analysis Platform to automate and improve credit analysis for the insurance market.

From a simple upload of a balance sheet or financial statement, the platform interprets data, calculates indicators, generates customizable scores, and delivers, within minutes, a robust analysis with technical and strategic insights — bringing greater agility, standardization, and reliability.